- ALL COMPUTER, ELECTRONICS AND MECHANICAL COURSES AVAILABLE…. PROJECT GUIDANCE SINCE 2004. FOR FURTHER DETAILS CALL 9443117328

Projects > COMPUTER > 2020 > NON IEEE > APPLICATION

Due to a rapid advancement in the electronic commerce technology, the use of credit cards has dramatically increased. As credit card becomes the most popular mode of payment for both online as well as regular purchase, cases of fraud associated with it are also rising. In this project, we model the sequence of operations in credit card transaction processing using a hidden Markov model (HMM) and show how it can be used for the detection of frauds. An HMM is initially trained with the normal behaviour of a cardholder. If an incoming credit card transaction is not accepted by the trained HMM with sufficiently high probability, it is considered to be fraudulent. At the same time, we try to ensure that genuine transactions are not rejected. We present detailed experimental results to show the effectiveness of our approach and compare it with other techniques available in the literature.

In case of the existing system the fraud is detected after the fraud is done that is, the fraud is detected after the complaint of the card holder. So the card holder faced a lot of trouble before the investigation finish. As all the transaction is maintained in a log, we need to maintain a huge data. Now a days lot of online purchase are made so we don’t know the person how is using the card online, we just capture the IP address for verification purpose. So there need a help from the cyber-crime to investigate the fraud. To avoid the entire above disadvantage we propose the system to detect the fraud in a best and easy way.

In proposed system, we present a Hidden Markov Model (HMM). Which does not require fraud signatures and yet is able to detect frauds by considering a cardholders spending habit. Card transaction processing sequence by the stochastic process of an HMM. The details of items purchased in Individual transactions are usually not known to any Fraud Detection System (FDS) running at the bank that issues credit cards to the cardholders. Hence, we feel that HMM is an ideal choice for addressing this problem. Another important advantage of the HMM-based approach is a drastic reduction in the number of False Positives transactions identified as malicious by an FDS although they are actually genuine. An FDS runs at a credit card issuing bank. Each incoming transaction is submitted to the FDS for verification.

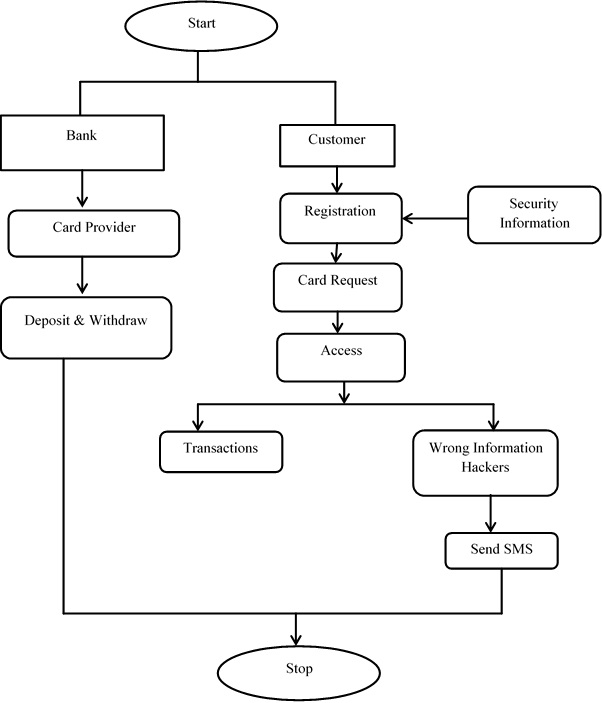

Architecture Diagram